Tutorial

Seasonality Trading Application

In this page, we will walk you through the details of Seasonality trading application and how to use it for your trading decisions. This is a fully web-based application running in a cloud VPS server and hence there is nothing to dowload or install. All you need is the subscription to the application, a computer with web browser and an internet connection. If you do not have subscription for the services, get it here.

Before you use the trading application every time, it is recommended that you check the status of our servers which host this application and our global Stock, ETF and derivative databases. This is intended to make sure that the trading application is available when you want to use it. We aim to achieve 99.99% availability. You may check the server availability by clicking the link here. Please bookmark this link so that you can have a quick access to the server availability webpage before you access the trading application.

Getting started with Seasonality trading application

The Seasonality trading application can be accessed in one of the two different ways. First, logging into the main Sapphire Capitals portal and Second, from a new tab in your web browser, both described below.

Log in to you Sapphire Capitals account

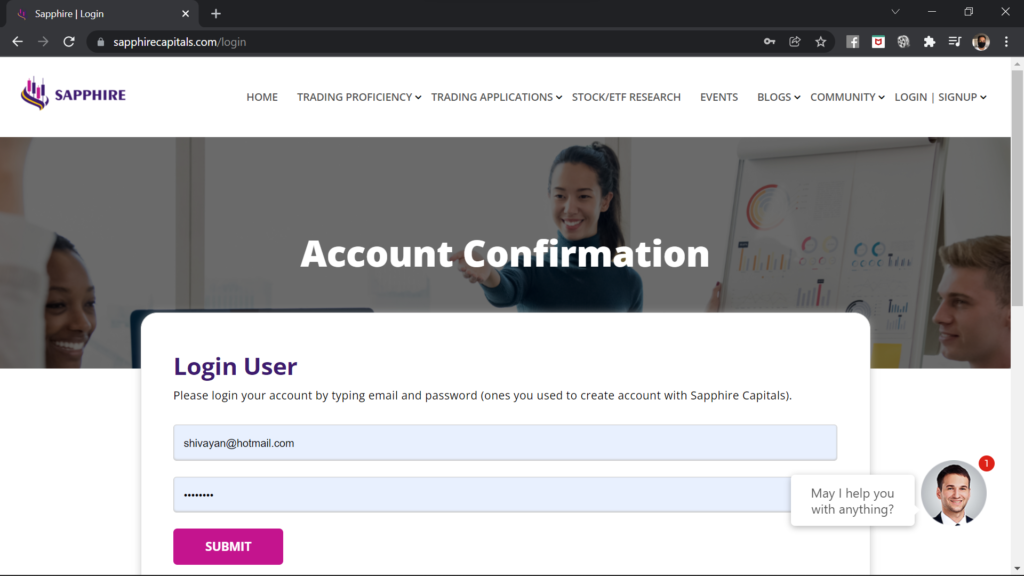

Go to the Sapphire Capitals portal at www.sapphirecapitals.com and click on LOGIN at the upper right corner of the page to go to the login page. The login page appears like below.

Please login with your email and password, if you already have an account with Sapphire Capitals. If you are a new subscriber, you would have received a temporary password with the welcome email after you had subscribed the service. You can login using your email and temporary password. It is recommended to change the password to a new one that you can easily remember and only known to you.

Once logged in, the Login/Signup menu at the top right corner is changed to an icon as shown in the image below.

Please go to the top of Sapphire Capitals portal and from the pull down menu under TRADING APPLICATIONS, select Seasonality Trading. This will take you to the Seasonality trading information page as shown below.

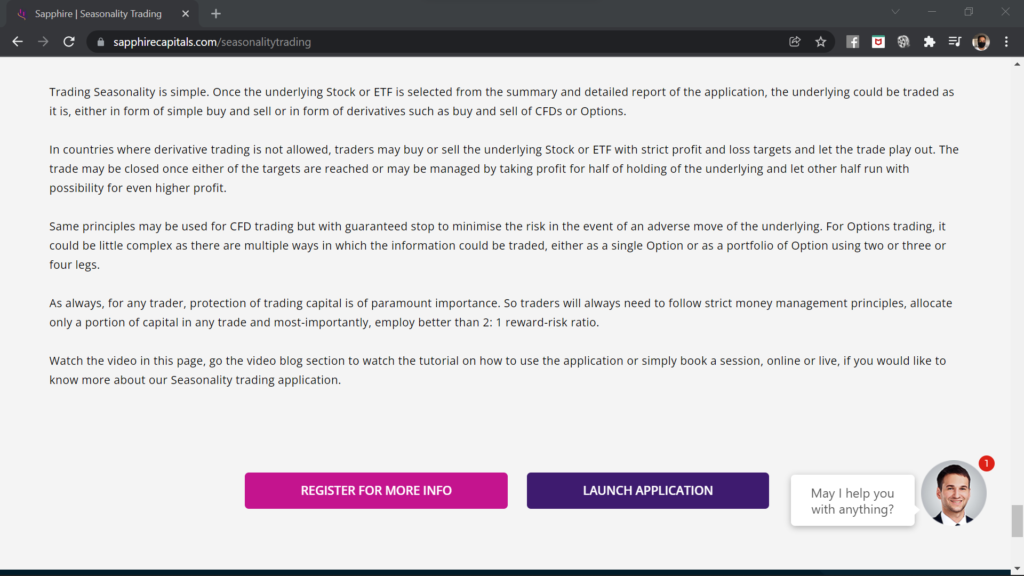

In the Seasonality trading information page, please scroll down to the bottom of the page. The bottom of the page should look like this, as shown in the image below.

Please click the deep purple button “LAUNCH APPLICATION” which will open a new tab in your web browser with the Seasonality trading application’s input (filter) page.

Fire up a new browser tab

Alternatively, you may open your browser or open a new tab in your web browser and type the following URL seasonalitytrading.sapphirecapitals.com as shown in the image below. If you are already logged in to Sapphire Capitals portal in your computer, it will open the Seasonality trading application’s input page.

If you are not logged in, it will ask you to login with your email and password as mentioned earlier. After clicking the SUBMIT button on the login page, it will open the Seasonality trading application’s input page.

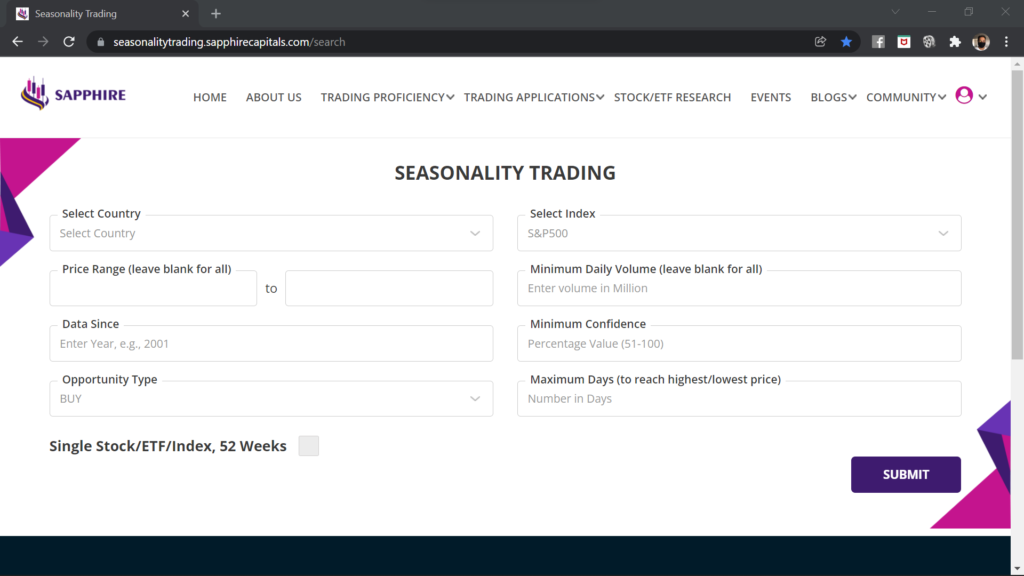

Either way you launch the application, you will see the following screen.

Input to the Seasonality application

The Seasonality trading application input page has two separate input sections, as explained below, depending upon how do you want the analysis to be performed by the application.

Main input section of the application

A total of 8 input parameters, some mandatory and some optional, make up the main input section of the Seasonality trading application. This is the input section you will use most of the time as this is intended for finding high probability seasonal Stocks among all Stocks in an index or the major ETFs in the country of your interest.

Full details of the parameters for this input section are described in a little while.

Single Stock/ETF/Index, 52 Weeks option

If you are looking to analyse only one Stock or ETF for seasonality over the 52 weeks period, you will use this input section. This is enabled by ticking the box next to “Single Stock/ETF/Index, 52 Weeks“. The input screen switches to a different format as shown in the image below.

Please note that, this optional feature is currently in Beta version (in trial phase and not fully ready for commercial release) and may not be available to your subscription.

Inputs to the Seasonality trading application - main section

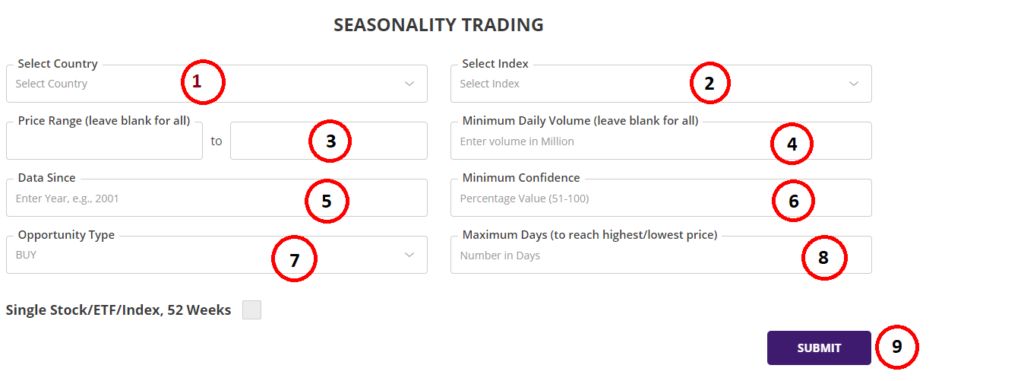

The main input section has 8 filter criteria marked from 1 to 8 followed by a submit button at 9 as shown in the image below.

The input filter criteria are as follows:

1. Select Country: Based on your subscription, you would be offered the selection of the countries from the pull down menu. If you subscribe to multiple countries, then you will be able to select one of those countries from the pull-down menu for running the Seasonality application, you can run the application only for one country at a time.

2. Select Index: The Seasonality report can be run one Index at a time for the selected country. If the selected country has multiple indexes or pre-configured list of Stocks and ETFs, you will be able to pick one of those Indexes or lists from the pull down menu for running the application.

3. Price Range: This is an optional parameter. If you want to look for Stocks or ETFs only within certain price range, then select the range in these two boxes, the left being the lower range and right box being the higher range. As an example, if you want to look for Stocks or ETFs above certain price, then only input the lower range parameter leaving the higher range blank. If you want to see for all Stocks or ETFs, then, leave both boxes blank.

4. Minimum Daily Volume: This is an optional parameter. If you want to only find Stocks or ETFs with daily trading volume above certain number, then type in the number in this box in millions. As an example, if you would like only to trade highly liquid Stocks or ETFs with daily trading volume of 1 million, then type in “1” in this box. If you want to see all Stocks or ETFs irrespective of their trading volume, then leave this input blank.

5. Data Since: This input is for the number of years for which you would like the application to perform the seasonality analysis. As an example, if you are running the application in 2022, then an input of 2002 will mean that the seasonality analysis will be performed for 20 year period, from 2002 to 2021 to provide you the probability of the trade for year 2022. It is recommended that the seasonality analysis is done for a minimum period of 10 years.

6. Minimum Confidence: This input filter is the minimum probability that you would like to trade with. In the application, Confidence is calculated as the % of times when the seasonality patterns had successful outcome to the number of years analysed, either bullish or bearish depending upon the selection of Opportunity Type. If you are looking for Stocks or ETFs with 90% confidence for BUY opportunities, then the same Stocks or ETFs will have a 90% probability of being bullish. Similarly for SELL opportunities.

7. Opportunity Type: Default is BUY. If you are looking for bearish trading opportunities (to profit from falling price of the Stock or ETF), then select SELL.

8. Maximum Days (to reach highest/lowest price): This is an optional input. If you are looking for Stocks and ETFs which reached the highest price (for BUY Opportunity Type) or lowest price (for SELL Opportunity Type) within certain number of days, then type in the number of days in this box. Leave it blank to ignore this filter.

9. SUBMIT button: Click this button after you have provided all the mandatory inputs and any other optional inputs.

The Seasonality trading application executes millions of calculations using the inputs you have provided on the selected Stocks and ETFs. We have implemented the best of technology to leverage the available computational power to bring the results of analysis fast. It will take several seconds to perform the complete computation and the time is dependant upon the number of Stocks or ETFs in the selected index or list.

As an example, analysis of 500 Stocks in S&P500 index will take more time than 100 Stock NASDAQ index or 300 Stocks ASX300 will take more time than 100 Stocks ASX100 and likewise.

Summary report - Seasonality trading application

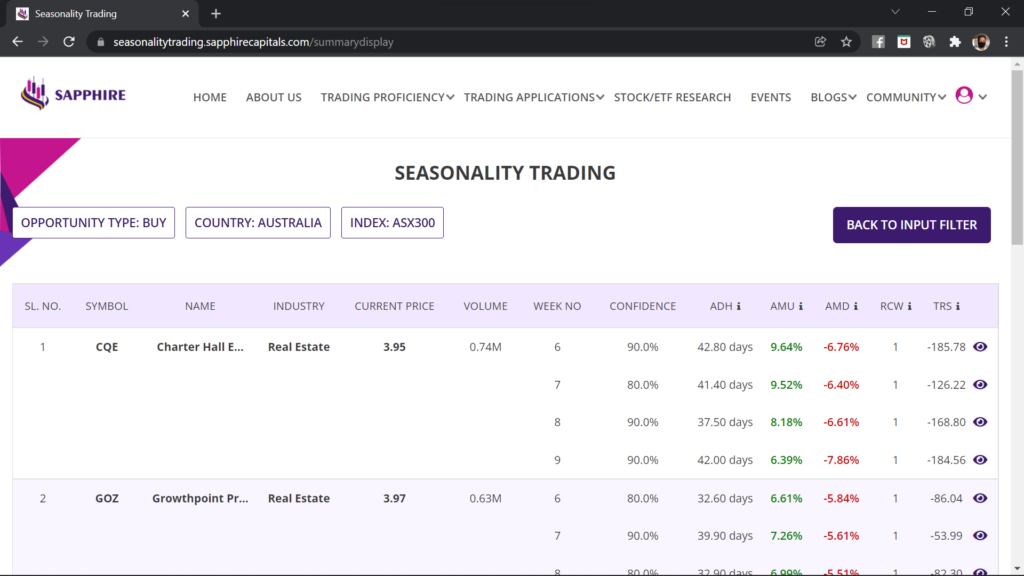

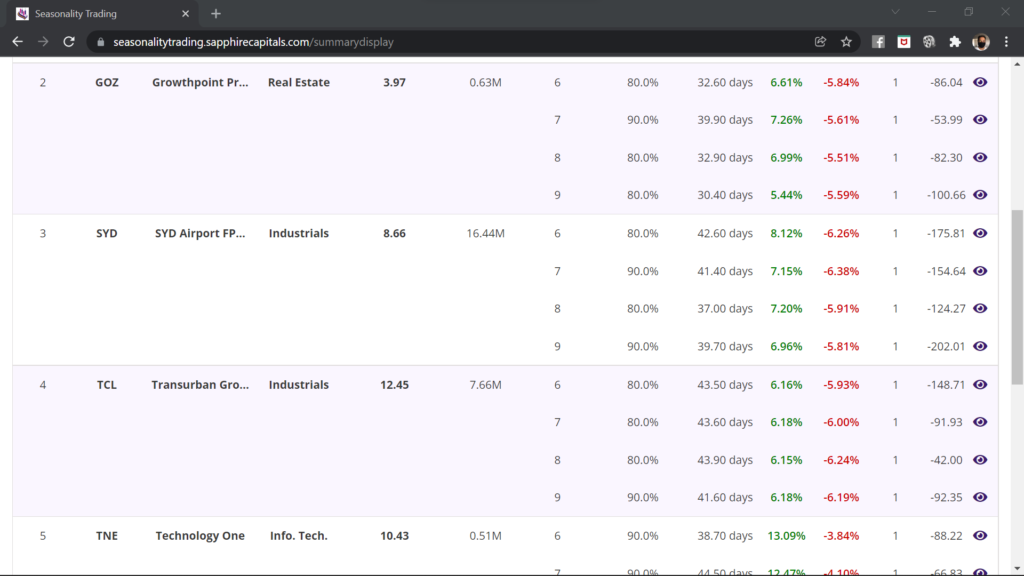

On completion of the analysis, the summary report is presented as shown in the image below.

Summary report can run into several pages depending upon your inputs as well as how many Stocks or ETFs were seasonal during certain weeks of the year. Please scroll up and down to review each row before you pick one or more of the Stocks or ETFs to drill down for further analysis.

Understanding the summary report

Let us break it down for you so you know what does the summary report contain and how to interpret the information provided in various sections of the report.

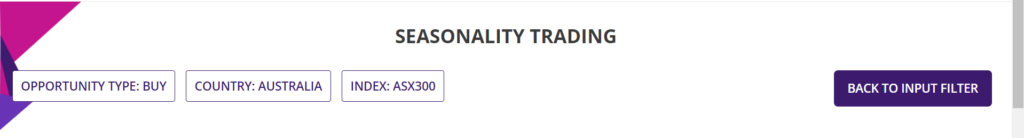

First up, to keep you informed, the top of the summary report shows you the opportunity type, country and index used for the analysis, see the image below.

The summary report consists of several columns of information for each row of Stock or ETF as shown in the image below.

The columns SYMBOL, NAME, INDUSTRY, CURRENT PRICE and VOLUME are self-explanatory and respectively provide the information on the Stock or ETF symbol, the company or underlying name, the industry to which the Stock or ETF belongs to, the last traded price and the last volume traded.

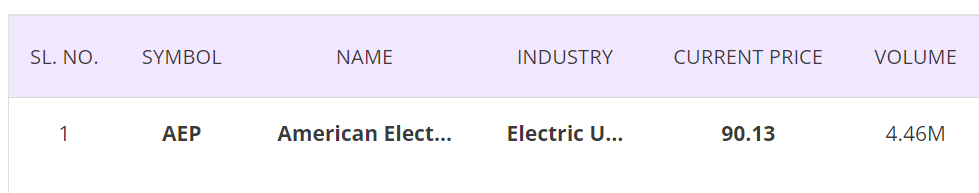

For some countries, the SYMBOL, NAME of the company and the INDUSTRY are abbreviated, as shown in the image below (example summary report of S&P500 Stocks from USA) because of how much screen real estate is available to display all the information. Hovering the mouse over the abbreviations will reveal the full text.

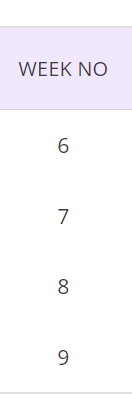

Each Stock or ETF is reported with 4 weeks of seasonality information, from the week following the week in which the application was run. In this tutorial example, the application was run in week 5 and hence the summary report is showing four weeks worth of seasonality information, from the week beginning week 6 till week 9 as shown in the image below.

If you run the application in Week 26, your summary report will show 4 weeks beginning Week 27 till Week 30. That way, not only you are looking at the immediately available trading opportunities of the week of your interest but also three more weeks after that, so as to provide you with a better view of how seasonality played out over a period of time.

Column CONFIDENCE is the probability of the Stock or ETF making bullish or bearish move, based on your desired Opportunity Type, for trades initiated on the first trading day of the week following the week when the application was run. The application provides summary reports for four such weeks as mentioned before.

In the summary report shown below, the example Stock has 90% probability of bullish move (BUY) in week 6 of 2022, as the Stock was bullish in 9 out of last 10 years during the exact same period of time (beginning of week 6 for 9 week period). For this tutorial example, 10 years of analysis was used, which is from 2012 to 2021, with “Data Since” input as 2012.

During these last 10 years and over the same period of time, the Stock had moved UP by an average of 9.64% (AMU or average move up) and moved DOWN by an average of 6.76% (AMD or average move down). Stock had to be held for an average of 42.8 days (ADH or average days held) for it to reach those high levels. You would be expecting to take profit around those many days after opening the trade, if not sooner.

Similar information is provided for week 7, week 8 and week 9. In this tutorial, the example Stock in the image shown below, has a probability of bullish move of 80% for week 7, 90% for week 8 and also 90% for week 9. Similarly, in those weeks, the AMD, AMU and ADH were as shown in the rows corresponding to the week number.

There are two more columns, names RCW and TRS, which provide additional information about the quality of seasonality. RCW is Recent Consecutive Wins, gives you an insight of how did the seasonality play out in recent years. TRS stands for TRend Strength, which is the slope (m) of the straight line (y = mx + c) multiplied by 100, fitted with the top of the histogram (will be discussed in the Charts section, little later). Hover the mouse over the “i” next to RCW and TRS for more information.

In brief, for BUY opportunity types, a positive TRS number indicates the trend is up and you could expect the next bullish move to be higher than previous years over the same period of time wheras a negative number would indicate that the trend is slowing and the next bullish move would be expected to be smaller than previous years. Similarly, the opposite applies for SELL opportunity types.

Pro Tip

Remember, Probability and Reward-Risk Ratio (RRR) are your best friends and your best weapon for predictable and consistent profitability while trading Stocks and ETFs. We have repeated this mantra several times across various pages of our website and communications, a doctorine that you would like to frame and always be mindful of before making your trading decisions.

While you will pick the Stock or ETF with certain minimum level of confidence but you will need to look at AMU (Average Move Up) and AMD (Average Move Down) very closely as well. For BUY opportunities, you would look for Stocks and ETFs that have AMU of at least 2X of AMD. Similarly, for SELL opportunities, you would look for Stocks and ETFs that have AMD of at least 2X of AMU. This is equivalent to a RRR of 2:1.

Higher the RRR, better it is for your long term trading success. So, please be mindful of AMD and AMU while picking the underlying Stock and ETF to trade, always higher than RRR of 2:1.

Detailed report - Seasonality trading application

The last column in the summary report has an eye icon, see right most side of the image in the section above. Click on the icon for a detailed report for the week. The detailed report opens up in a new tab of your browser as shown in the image below.

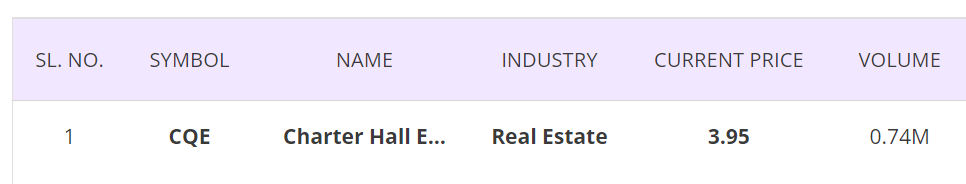

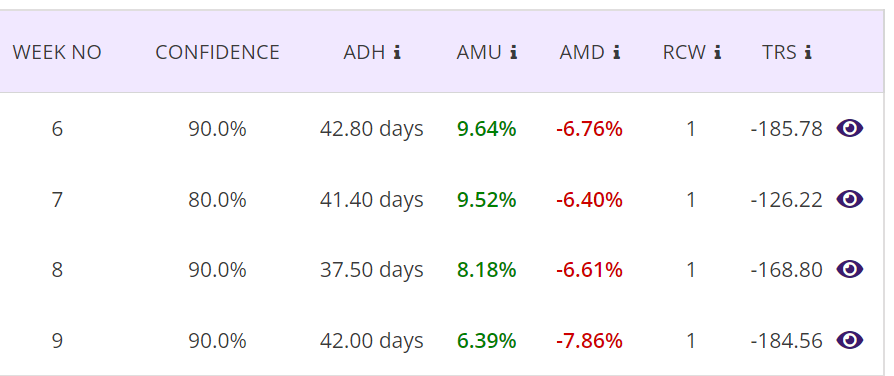

Since you could potentially have multiple detailed report open for each of the Stocks or ETFs for various weeks, the top of the detailed report shows the Stock or ETF being looked into such as Symbol, Opportunity type and the Week no. In this example, you are looking at the detailed report for all bullish (BUY) trades beginning first trading day of week 6 for last 10 years for the Stock CQE.

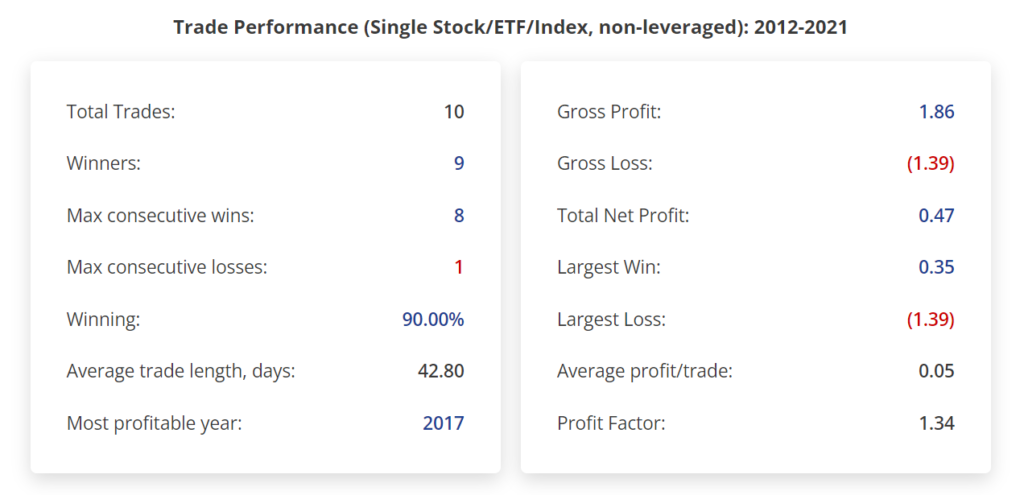

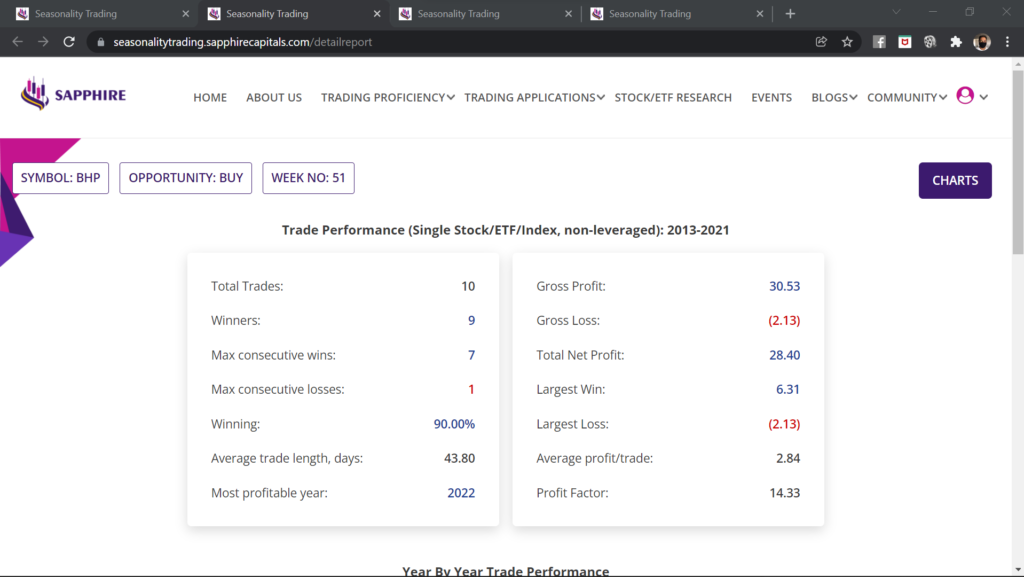

The detailed report has two different sections providing two different sets of information. In the image below, you have the top section named “Trade Performance (Single Stock/ETF/Index, non-leveraged)“.

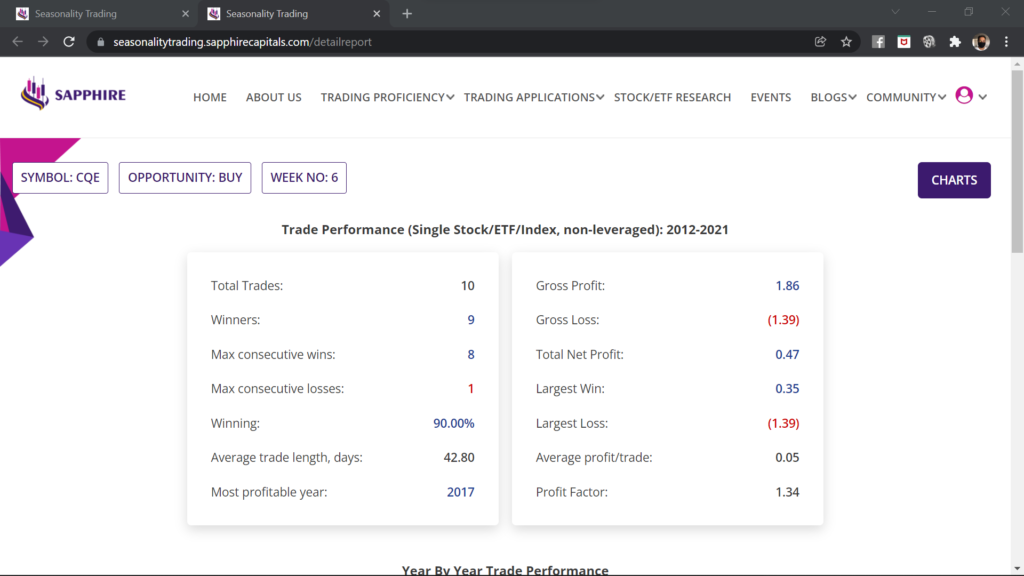

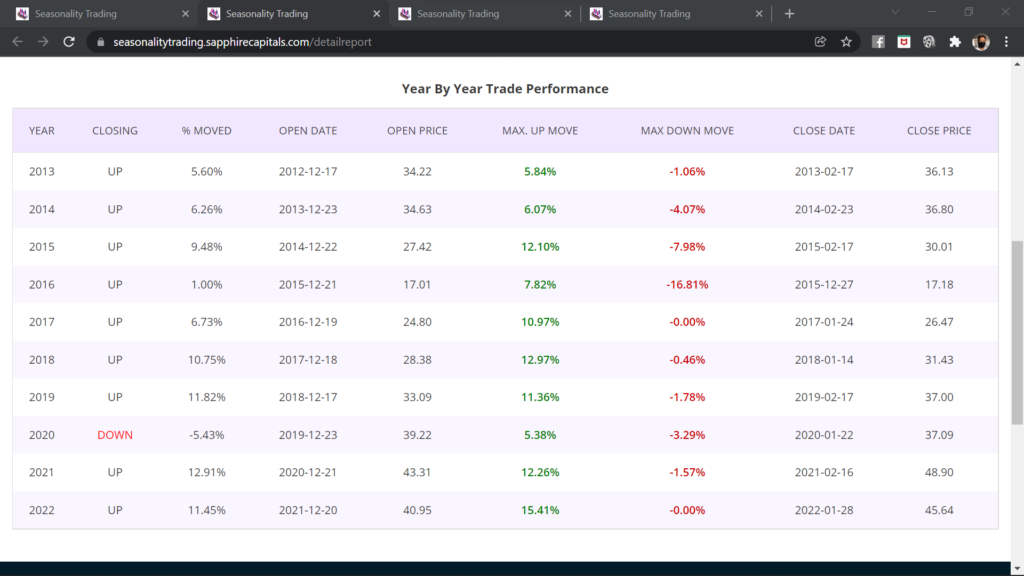

The bottom section of the detailed report is as shown in the image below. It is the “Year By Year Trade Performance” report, we will explain subsequently.

Understanding the detailed report - Trade Performance

This is the top section of the detailed report, see the image below. The section provides a snapshot of all the trades, if taken in week 6 of every year for last 10 years, with just one Stock or ETF without using any leverage. For simplicity, there is no commission assumed as commissions do vary and some brokerages do not charge any commissions! Also, most certainly, you would be trading more than one Stock or ETF per trade which will affect your commission and net profit from the trades.

In the left side of the section, in the image above, Total Trades, Winners, Max consecutive wins, Max consecutive losses are self explanatory. Winning is the Confidence as defined earlier, which is also the probability you are looking for. Average trade length is also the ADH or Average Days Held as in the summary report. And lastly, the section includes the Most profitable year, or the year in which the underlying Stock or ETF made the largest move, either bullish or bearish, depending upon your choice of Opportunity type.

The right hand side of the section above shows the trade performance in terms of the underlying currency of the Stock or ETF. As an example, if you are looking at US Stocks or ETFs, then the numbers in this section will be in USD. Or if you are looking at Indian Stocks or ETFs, then the numbers are in INR and so on.

Continuing with the same example, for last 10 trades taken in week 6 in each of last 10 years, the Gross Profit from 9 winning trades would have been 1.86, Gross Loss would have been 1.39, resulting in a Total Net Profit of 0.47 with an average profit per trade of 0.05. The largest win in those 10 trades would have been 0.35 and largest loss would have been 1.39, the only loss in last 10 years.

And lastly, the Profit factor is a quotient of gross profit and gross loss. You would be looking to trade Stocks and ETFs with profit factor as high as possible, anything over 2.0.

Understanding the detailed report - Year By Year Trade Performance

As the name implies, in this section of the detailed report, you can see how the underlying Stock or ETF moved during the 9 week period beginning the first trading day of Week 6 of the year for each of the years from 2012 till 2021. As an example, in the year 2021, the trade was opened on 8th February at opening price of 3.01. Since opening the trade, the Stock moved UP by 7.97% and DOWN by 1.33% and finally closing at 3.23 which is 7.31% higher than the opening price.

Similar figures and numbers are provided for each of the 10 years beginning 2012 and till 2020, in this section of the detailed report.The only loss year for the stock was in 2020 when the stock markets around the world was in meltdown because of the Covid outbreak.

BTW, you can see the effect of seasonality that for most years, the MAX UP MOVE was very significantly higher than the MAX DOWN MOVE. Please note that, whenever you trade a Stock or ETF, it will almost never go straight UP or DOWN, it will hover around the current price or make brief moves in either direction before it will make big bullish or bearish moves.

Get visual with charts

In the detailed report page, look at the CHARTS button at the top right hand side of the page as shown in the image below. Clicking on the button opens up charts in a separate tab of your browser.

Line chart

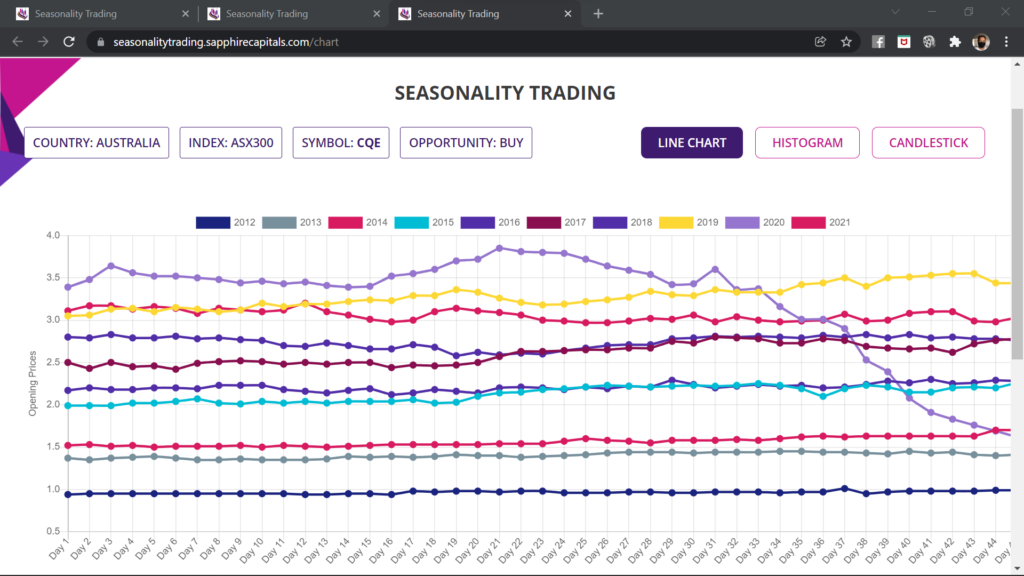

The Chart page opens up with the Line chart as shown in the image below. The top of the chart page shows you the critical information of interest to you such as the country, index, symbol and opportunity type, so you know what chart are you looking at.

This line chart is an interactive chart with 10 lines, in this example seasonality analysis for 10 years, each line corresponding to one of those 10 years. Each line is in different colour, idenfied by the legend at the top of the chart. Click on the legend colur box with the year next to it, to switch that line on of off. You may selectively switch on or off certain lines pertaining to certain years to visually analyse how seasonality had played out in certain years better than the others etc.

Histogram

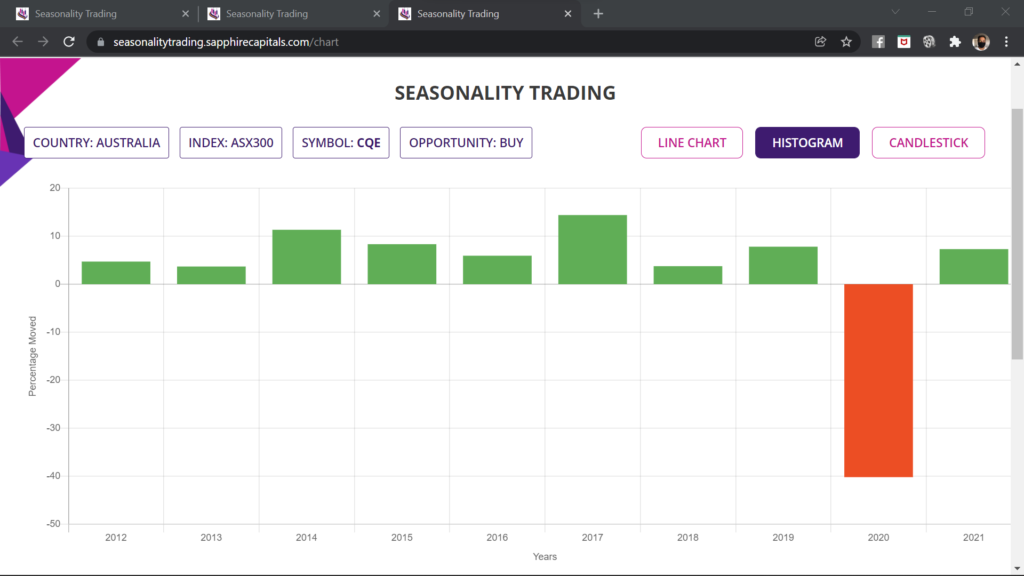

The second chart that can give you a very quick visual clue of the size of the seasonal moves during the nine weeks period is the Histogram chart. You can get to this chart simply by clicking the HISTOGRAM button on the charts page.

The histogram chart is drawn with each bar height proportionate to the percentage move the Stock had made in each of those 10 years of analysis. The histogram will have 20 bars for 20 years of analysis. You may hover the mouse on the histogram bars to know the % move of the Stock for that particular year.

Candlestick chart

By clicking the CANDLESTICK button at the top of the charts page, you can see one candlestick chart of the Stock, for 13 weeks period, for each year of seasonality analysis; in this example, it is for 10 years. If you run the seasonality analysis for 20 years, then you can see one chart for each of those 20 years.

The candlestic chart is also an interactive chart with a pull-down menu for the period of the year to display. In the example candlestick chart shown in the image below, it is showing the chart for the year 2017. By selecting the year from the pull-down menu on the upper left corner of the page, you can display the candlestick chart for any other year, from 2012 to 2021.

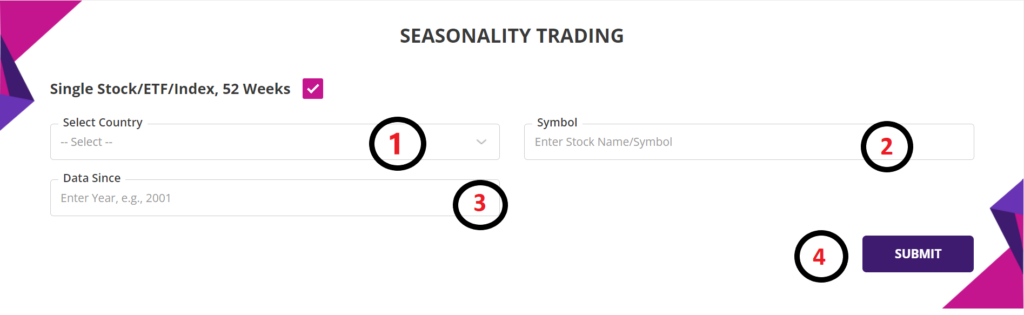

Single Stock/ETF/Index, 52 Weeks option

The Single Stock/ETF/Index, 52 Weeks option is currently in Beta version and an optional feature, may not be available to your subscription level. The trial version, if available to your subscription, may provide you an alternative method of seasonality analysis for one single Stock or ETF.

The input screen for this option is much simpler as only three different inputs are required for the application to start analysis, all these are marked by numbers 1 to 3 followed by SUBMIT button marked number 4.

Let’s look at the various input parameters for this option of analysis:

1. Select Country: You can pick the Country as described in the main input section of the application, using the pull-down menu.

2. Symbol: Since this is for analysing single Stock or ETF or Index, you will need to type in the Symbol of the Stock or ETF of your interest. As you start typing the first letter of the symbol, it will auto-suggest the symbols based on your typing input.

3. Data Since: This input has the same meaning as described in the main input section of the application. Please note that, depending upon the Symbol name you provided, the application will automatically pick the year since the Stock or ETF data is available in our Stock database. You may, however, type in another year of your choice; for example type in 2002 for 20 year analysis or 2012 for 10 year analysis.

In this example analysis, the inputs used were as shown in the image below.

Summary report - Single Stock/ETF/Index, 52 Weeks option

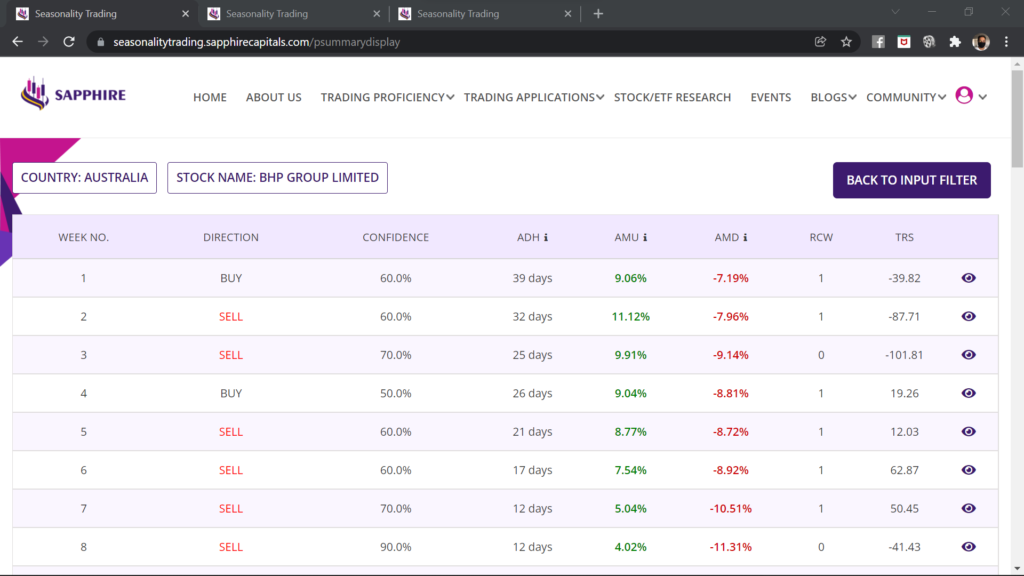

The Page 1 of the summary report for this analysis is as shown in the image below. The top of the page is showing the Country and the Name of the single Stock or ETF being analysed.

Since it is a 52 weeks report to cover for the 52 weeks of the year, the summary report runs in several pages as shown below. For each of the 52 weeks, you can see the WEEK NO. DIRECTION, CONFIDENCE and other information such as ADH, AMU, AMD, RCW and TRS. All these columns have the same meaning as in the summary report from the main input section described earlier. The DIRECTION in this summary report is used to mean whether the Stock or ETF was bullish over the 9 week period beginning the first day of the trading week. As an example from the image below, Week 1 of the year was bullish (BUY) 60% of the time or 6 out of last 10 years whereas Week 51 was bullish 90% of the time or 9 out of last 10 years.

In terms of the trading decision, bullish (BUY) trades initiated on first trading day of Week 1 of the year for this Stock has only 60% probability whereas Week 51 has 90% probability.

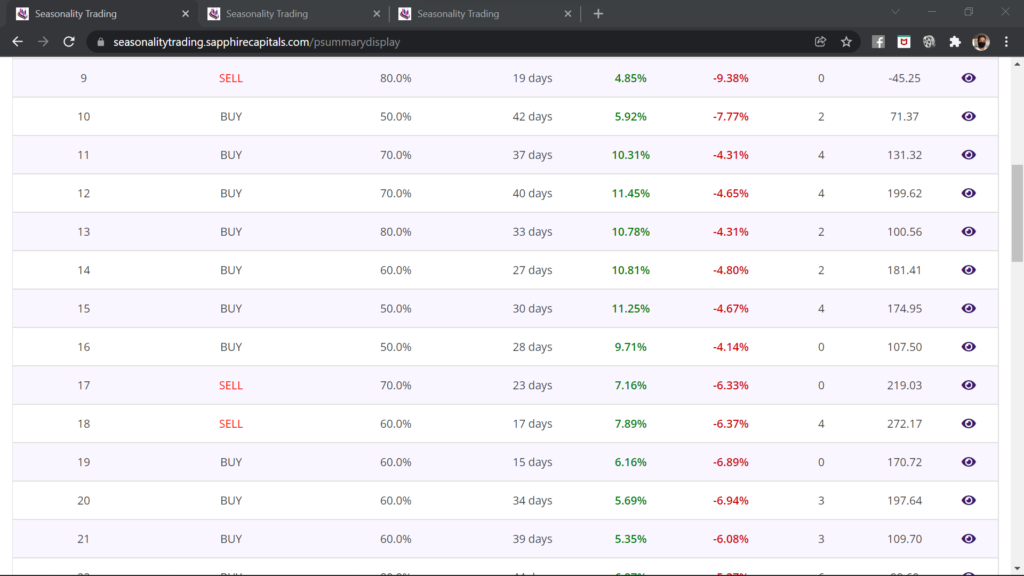

Page 2 of the report as shown in the image below.

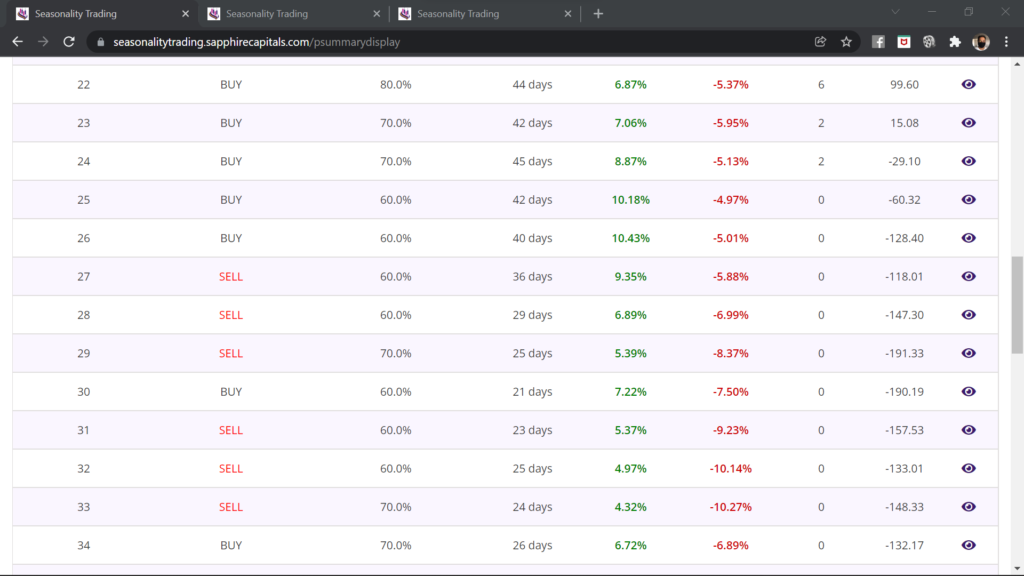

Page 3 of the report as shown in the image below.

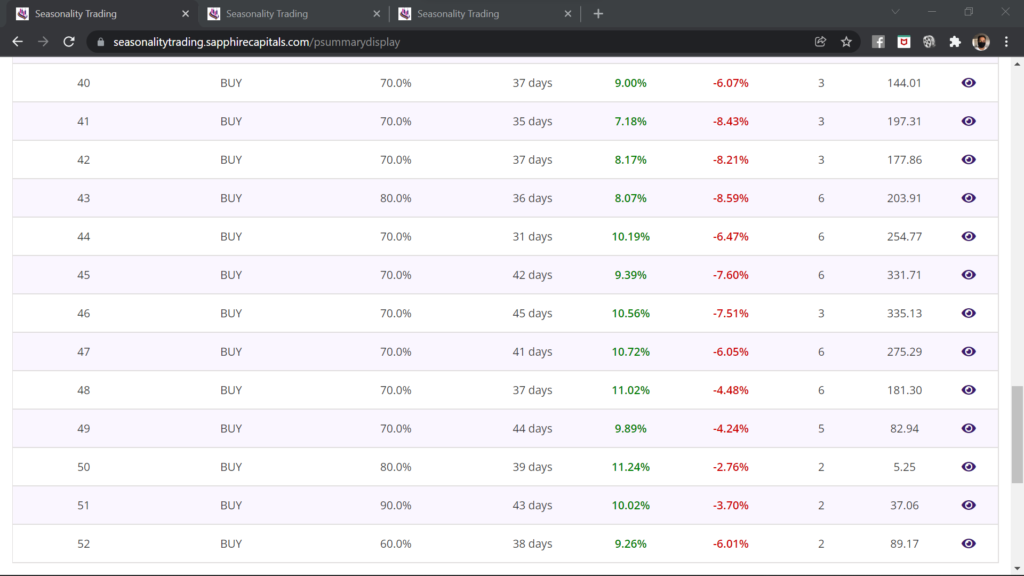

Page 4 of the report as shown in the image below.

Detailed report - Single Stock/ETF/Index, 52 Weeks option

The detailed report for each week can be accessed by clicking the eye icon in the right most column of each row. Clicking the eye icon will open up the detailed report for that week in a seperate browser tab.

The detailed report for Single Stock/ETF/Index, 52 Weeks option also has two sections, upper section with Trade Performance (Single Stock/ETF/Index, non-leveraged) and a lower section described little later.

The upper section with trade performance has same meaning and details as in the detailed report from analysis with the main input screen.

The lower section with Year By Year Trade Performance is as shown in the image below. The columns have the same names and description as in the lower section of the detailed report from analysis using the main input screen.

Charts - Single Stock/ETF/Index, 52 Weeks option

Charts for the Stock and ETF analysed by the Single Stock/ETF/Index, 52 Weeks option can be accessed by clicking the CHARTS button on the top right corner on the detailed report as discussed above. You can access the same three different types of charts such as Line chart, Histogram chart and Candlestick chart. The description and details provided by the charts are same as those provided in the detailed report when analysed using the main input.

More information on using the application

If you require more information on using the application, please reach out for support to admin@sapphirecapitals.com. Alternatively, you may send a message or chat to us via WhatsApp by clicking the icon on lower right hand side of your computer or smartphone screen. Additionally, keep an eye on invitations to attend live sessions, held periodically, on this and other applications we provide. In these sessions, you can ask questions on using the application, reports, charts or whatever and have your answers in a live interactive session.

FAQ

Please review the top section of the tutorial on how you could gain access to the application. At the time of signing up, you would have received an email with temporary password and redirected to the login page to gain immediate access to the trading application.

For regular use of the application and ease of use, it is recommended that you bookmark the Seasonality application page and open the page, as and when you require access. You will be asked to login when you open the page unless you are already logged in from your computer.

There is currently no limit on how many times you can run the application. Since, the application is designed to show you the opportunities beginning the first trading day of the week following the week in which you are running the application, you can run it only once a week to pick the Stocks and ETFs that you would like to trade. This is because, you will get the same results in all days of the week unless you change the input filter criteria.

Sometimes, it is possible that the there are no Stocks or ETFs meeting your filter criteria and hence there are no results to display. In most cases, that would be because you are looking for Stocks and ETFs with very high Confidence. Try running the application again with a lower Confidence input and you should get results.

The trading application runs millions of calculations using the parameters you have provided over the selected Stocks and ETFs in the database. We did our best to optimise the codes so as to bring the results faster but we are only limited by what the contemporary technology is able to provide. The time taken to deliver the results is mostly dependant on the size of the index that you are asking to analyse. As mentioned, an index with 500 Stocks will take longer than an index with 100 or 300 Stocks. We will however, continue to work on bringing superior technology for faster delivery of results, as and when we are able to do so.

Once you have made a decision to trade the underlying Stock or ETF that meets your criteria for Probability and RRR (AMD, AMU ratio), you can trade in many different ways depending upon the country you are in and what trading instrument your broker allows such as Stock, CFD or Options.

If you are allowed only to trade Stock, then you can BUY/SELL the Stock or ETF with strict SL/TP (preferably guaranteed SL). If you are allowed to trade CFD, then you can trade similar to trading Stock as just mentioned, except that you will need much lower capital to trade because of leverage available with CFDs. CFD trading is available in Australia and many parts of Europe, but MUST be treated with utmost care because leverage magnifies the wins and losses. Guaranteed Stop should be used as often as possible for protection of your trading capital.

If you are in a country where Option trading is available and your broker allows you to trade, then you could trade in many different ways, some with built-in risk management. Options trading is a vaste subject, we have a training program which you might like to have a look at. Debit spread is one of the Options trading strategies which strictly limits your risk on the downside with very significant RRR. Keep an watch on our blogs for information on strategies like this.

In Seasonality trading application, the calculations are based on the Stock or ETF price at the opening of market at the first trading day of the week following the week in which the application was run. So, it is recommended that you open the trade as the market opens after the weekend, which will be mostly Monday, unless Monday is a public holiday with no trading in which case it would be Tuesday.

After opening the trade with suitable Stop-Loss (SL) and Take-Profit (TP) setting, you would be observing the market to see if either TP or SL is hit. Your TP and SL setting are going to be AMU and AMD respectively for bullish trades and otherway for bearish trades. Because of this being a high probability trade, you would be expecting your TP to be hit within the ADH days. If for some reason, the Stock or the ETF was hovering close to your TP but not quite getting there, it is adviseable to manually close the trade within 9 weeks after the trade was opened.

You may trade seasonality throughout the year for all 52 weeks. As you will learn while using the Seasonality trading application, that different Stocks and ETFs exhibit seasonal behaviour at different times of the year. So there are plenty of trading opportunities as long as you look for it.

Another point you might like to note while using this trading application or any of our other ones, that your trading decision better be aligned with the broad market trend. If it is a BULL market, you would like to have more bullish trades than bearish trades whereas in a BEAR market, you would like to have more bearish trades than bullish trades. Although seasonal Stocks and ETFs often defy the market trends, but it is better to adhere to these for higher probability of your trades playing out as per your assesment.